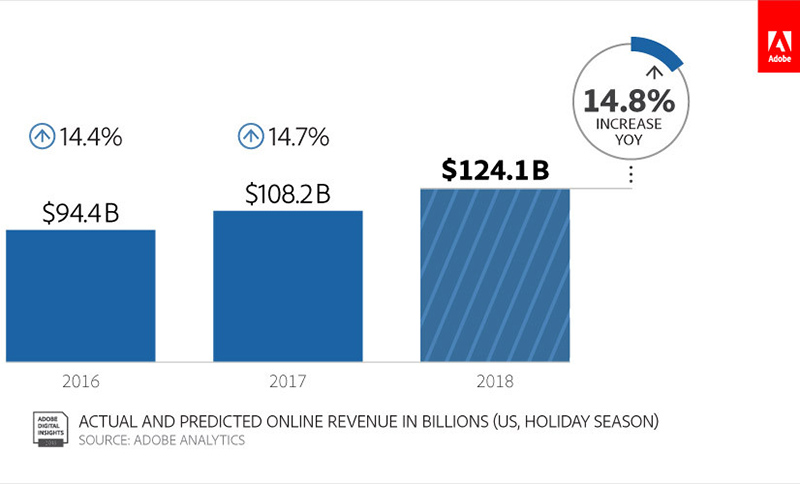

Adobe's online holiday shopping predictions indicate a U.S. holiday sales increase online of 14.8 percent ($124.1 billion). Conversely, offline retail spending increases less: 2.7 percent. Cyber Monday will set a new record as the largest and fastest-growing online shopping day of the year: $7.7 billion. This is a 17.6 percent increase year over year (YoY). Online sales 7 to 10 p.m. Pacific on Cyber Monday will drive more revenue than a full day. Therefore, conversions will hit 7.3 percent during these golden hours of online retail.

Special Shopping Days

Thanksgiving Day sales will increase by 16.5 percent: $3.3 billion. Afterwards, consumers will spend one out of five dollars between Thanksgiving and Cyber Monday, $23.4 billion of total online. One extra day between Cyber Monday and Christmas Day will give retailers a $284 million boost in sales. A record number of days will hit new sell milestones: 36 days over $2 billion. Hot gifts include 4K TVs, retro video game consoles, and toys such as Pomsies, Grumblies, and Fortnite Monopoly.

Online combined with Brick and Mortar

Sellers with online and brick stores will see 28 percent higher sell online over ones just online. Shoppers buy online and pickup items in-store (BOPIS) as part of the holiday sales increase. Overall, BOPIS went up 119 percent since January 2018 across all retailers and 250 percent for large. At the same time, half of shoppers browse in-store for products they plan to buy online later.

Additional Predictions

Top-Selling Products

Adobe predicts one percent of SKUs will drive a record 70 percent of holiday sales increase. 4K TVs, retro video consoles, and games Tekken 3, Ridge Racer Type 4 and Final Fantasy VII, will perform well. Top toys: Fingerlings, Fortnite Monopoly, Grumblies, Hatchimal Hatchibabies, Jurassic World Jeep Wrangler, and Pomsies.

Best Days for Deals

Black Friday reigns supreme for discounts on electronics, including tablets, TVs and computers. On the Sunday before Cyber Monday, shoppers will see the best deals on apparel, appliances, and jewelry. Cyber Monday will see the largest discounts on toys. Giving Tuesday for furniture and bedding and Thanksgiving for sporting goods.

Mobile Revenue Opportunity

Smartphones gain as the fav device for shopping, 48.3 percent of visits and 27.2 percent of revenue. Mobile revenue is up 11.6 percent YoY. Yet, completed cart orders happen over 20 percent less on smartphones than desktop from bad checkout tries. Closing this gap equates to $9 billion in mobile sales. Tablets are down: only 8.8 percent of visits and just 9.6 percent of sales. Mobile apps give more browsing and double complete sales than web, part of holiday sales increase.

Emerging Shopping Trends

Voice-assisted shopping is on the rise. Twenty-one percent of shoppers report they are planning to reorder frequently-purchased items. At the same time, seventeen percent placing one-time orders for in-store pickup using their voice devices. Adobe expects holiday shoppers to ship and return purchases more often than to the rest of the year. Also, buyers will shop more for things like cruises and hotels on Cyber Monday. More buyers will stay home on Thanksgiving Day. Sixty percent report they won't shop in stores on Thanksgiving Day, up from 40 percent in 2016.

Top Revenue-Driving Marketing Channels

Sellers will use loyal buyers that go directly to their website, with revenue per visit (RPV) rising at 36 percent. Search has the second highest RPV growth at 23 percent, followed by helper/comp sites (15 percent) and email (8 percent).

Social Losing Value for Retailers

Referral traffic from social will generate 11 percent less RPV compared to Q4 2016. Likewise, social is the only marketing channel to see a decline in RPV, despite social traffic rise. This may be a result of weakening trust in them. Overall, shoppers will use social media sites 25 percent less for gift ideas this year.

Adobe Analysis Methodology

In seeing this holiday sales increase, Adobe used Adobe Sensei. The smart software takes retail insights from trillions of data points that flow through Adobe Analytics. This is part of social, ads, targets, and feel products. One trillion visits to retail sites, 55 million SKUs, and 80 large U.S. web retailers add to results.

Adobe's study spans sellers across fifty item groups for its view of online shopping. For example, Adobe Experience Cloud manages more than 200 trillion data transactions annually. Side research is based on a survey of over 1,000 U.S. buyers in October 2018.